6 Ways to Manage Financial Stress And Be More At Peace: Tips From The Pros

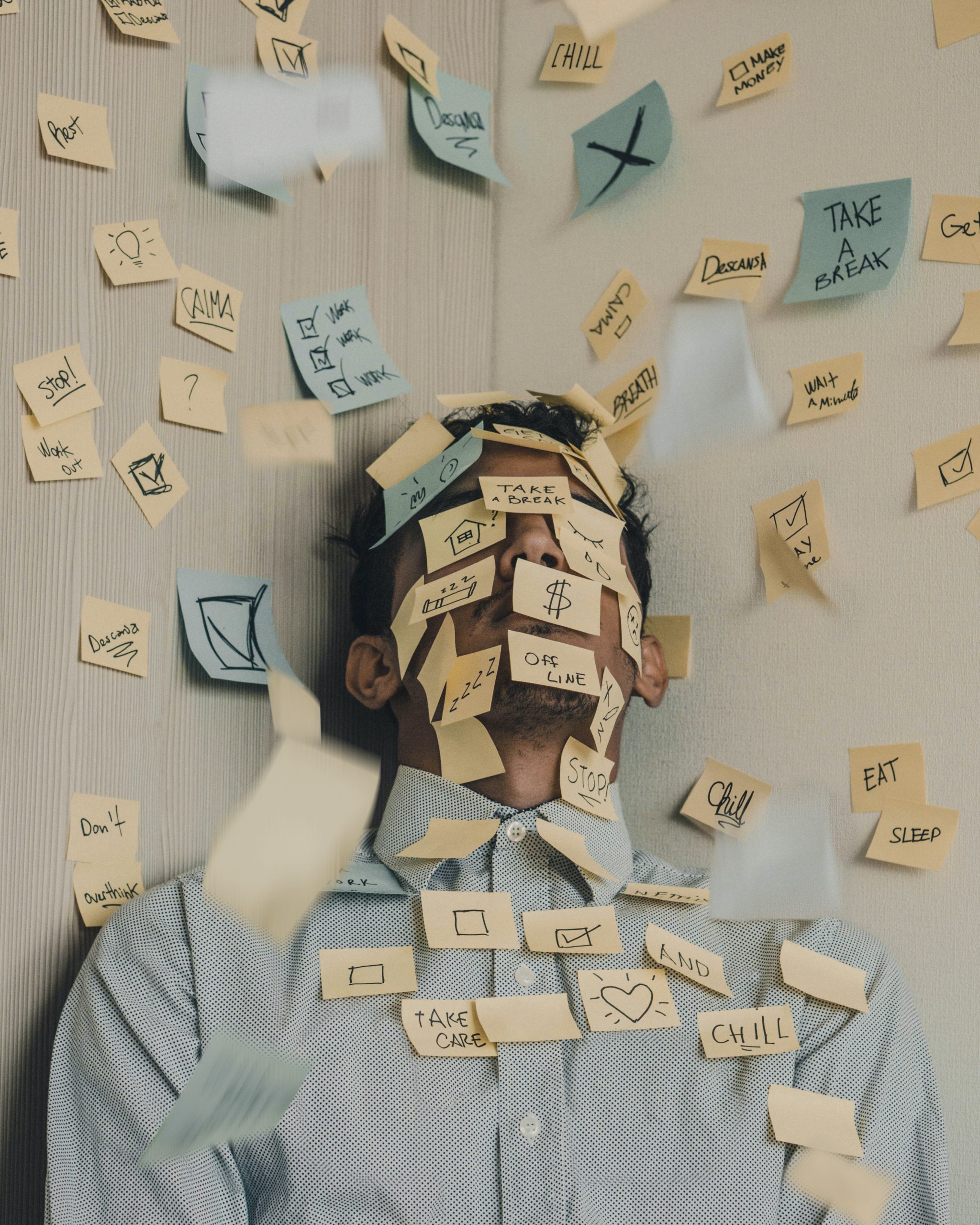

Managing finance is one of the leading causes of stress in people’s lives. According to a study, it is found that 73% of Americans reported feeling stressed about money at least some of the time. This number is no surprise, especially when you consider all the financial concerns people face nowadays – from paying off student loans to saving for retirement. If you’re looking for ways to manage your financial stress and be more at peace, read on for tips from the pros!

When it comes to money matters, there are a lot of stressful things to worry about – rising debts, unexpected expenses, and fluctuating market conditions, just to name a few. But by taking a proactive approach to managing your finances and practicing good habits like budgeting, saving, and investing wisely, you can find more peace of mind and ultimately manage any financial stress that may arise.

Causes Of Financial Stress

- Most people can attest to the fact that one of the biggest causes of financial stress is paying mortgage or rent. For many, this payment is due at the beginning of the month and can be a real struggle to come up with.

- Lack of stable income can be a major cause of financial stress for many people. Factors such as unemployment, insufficient wages, or unexpected expenses can make it difficult to meet one’s basic needs, impacting everything from housing to food security. Price fluctuations in key commodities like gas and food only make things worse, leaving many families living paycheck to paycheck in a constant state of uncertainty.

- There are many factors that can lead to financial stress when it comes to paying for education. Some of the key causes include rising tuition costs, high student loan interest rates, and the lack of financial support from federal or state governments. Other contributors, such as the rising cost of living and unpredictable changes in the job market, can also put pressure on students and their families to make ends meet.

- There’s no question that wanting a nicer lifestyle can be a major cause of financial stress. After all, if you’re constantly comparing your own lifestyle to that of others, it’s easy to start feeling like you’re falling behind. And when you’re already struggling to make ends meet, the idea of trying to keep up with the Joneses can feel downright impossible.

- When it comes to financial stress, one of the main causes is not having enough money to fund an emergency. This can be a difficult situation to manage, especially if you have a family or dependents.

- Not being able to retire is a major source of financial stress for many Americans. There are a number of factors that can contribute to this stress, including the rising cost of living, declining job security, and the increasing longevity of retirees. For many people, the thought of working well into their golden years is simply not an option. This can lead to feelings of anxiety and despair, as well as an increased risk of financial instability in retirement.

- One of the main causes of financial stress is debt. Whether it’s credit card debt, student loans, or a mortgage, debt can put a lot of pressure on your finances.

How to manage Financial Stress?

6 Ways To Manage Financial Stress

1 . Tackle One Problem At A Time

Many of us are juggling a lot of different responsibilities these days. We have to manage our careers, our families, our homes, and our social lives, all while trying to stay healthy and sane. It’s no wonder that so many of us feel financially overwhelmed and stressed out! One way to help manage this stress is to focus on one issue at a time.

By tackling one problem at a time, we can break it down into manageable pieces and work through it step by step. This approach can be especially helpful when it comes to financial stress. When we’re facing a big financial challenge, it can be tempting to try to solve all of our problems at once. However, this often leads to overwhelm and can even make the situation worse. Instead, focus on one issue at a time and take small steps to manage it. You’ll be surprised at how much easier it is to achieve your financial goals when you take things one step at a time.

2 . Set Realistic Goals

When it comes to setting financial goals, it’s important to be realistic. If your goals are too lofty, you’re setting yourself up for disappointment and frustration. On the other hand, if your goals are too modest, you may not push yourself enough to achieve success.

The key is to find a happy medium, setting goals that are challenging but still achievable. This will help you manage financial stress and stay motivated to reach your targets. Keep in mind that your goals may change over time, so it’s important to be flexible and adjust your plans as needed. By taking a realistic and flexible approach to goal-setting, you can stay on track to achieving your financial dreams.

3 . Do Not Hesitate To Ask For Help

If you’re feeling overwhelmed by financial stress, it’s important to ask for help. You don’t have to go through this alone. There are plenty of resources available to help you manage your money and get your finances back on track. Talk to a financial planner or counselor about your options. They can help you create a budget, make a plan to pay off debt, and find ways to reduce your expenses.

There are also many online resources that can help you get started. Check out websites like Mint or Dave Ramsey for tips on how to stay within your budget, save money, and make smart financial decisions. Don’t hesitate to ask for help when it comes to your finances. With the right resources, you can manage your money and get back on track financially.

4 . Budgeting

One of the best ways to manage financial stress is to create a budget. This can seem daunting, but it doesn’t have to be complicated. Start by taking a look at your income and expenses for the month. Make sure to include all sources of income, even if they’re irregular. Then, list out all of your expenses, including fixed costs like rent and utilities, as well as variable costs like groceries and entertainment.

Once you have a clear picture of your finances, you can start setting aside money for different purposes. For example, you might want to create a savings account for emergencies or put money towards a specific goal like a new car or a down payment on a house. Creating a budget can help you get control of your finances and reduce stress in the long run.

5 . Find Money Stressing Cause

When it comes to money, everyone has their own unique triggers for financial anxiety. For some, it might be the fear of not having enough money to pay the bills on time or feeling overwhelmed by credit card debt. For others, it might be the stress of trying to save up for a big purchase, like a home or car. Whatever your specific triggers may be, there are strategies that you can use to manage your financial stress and take control of your finances.

The first step is to identify these triggers and understand what causes you to feel anxious. Then, try setting up systems and routines to manage these feelings and build better habits when it comes to money. This could mean automating certain payments so that you never have to worry about forgetting them or creating a spending plan that helps you stay on track with your budget.

Other strategies may include seeking out support from family or friends who can offer encouragement when times get tough. Ultimately, finding effective ways to manage your financial anxiety is key to taking control of your finances and living a happier, more peaceful life.

6 . Learn To Manage Financial Stress

Stress is a normal part of life, but when it comes to money, it can feel especially overwhelming. If you’re struggling to pay your bills or feeling anxious about your financial future, you’re not alone. Learning how to manage your money stress is key to maintaining your mental health and well-being.

There are a few simple steps you can take to start reducing your money stress. First, get organized and create a budget. This will help you get a clear picture of your finances and curb spending in areas where you may be overindulging. Second, make a plan for your debt.

Whether you’re working on paying off credit card debt, student loans, or other types of debt, having a plan will help you stay on track and avoid accruing more debt. Finally, build up an emergency fund. This will give you a cushion to fall back on in case of unexpected expenses or income changes.

Start small and be patient with yourself as you work on reducing your money stress. Remember that everyone’s financial situation is unique, so what works for someone else may not work for you. The important thing is to find what works for you and stick with it.

Conclusion

Financial stress can be debilitating and overwhelming, but it doesn’t have to control your life. These six tips from the pros will help you manage your money better and find more peace of mind. Learn more about bad money habits and how Financial Freedom is related to controlling your emotions. Have you tried any of these methods? Let us know in the comments!

One thought on “6 Ways to Manage Financial Stress And Be More At Peace: Tips From The Pros”

Comments are closed.