10 Financial Metrics for Startups: How to Grow and Scale Your Business

As a startup, you are constantly trying to find new ways to grow and scale your business. But how do you know if you are making righteous decisions? One way to measure your progress is by tracking financial metrics.

This article will discuss 10 financial metrics that startups should track in order to make sound financial decisions. By understanding these metrics, you will be able to assess your company’s financial health and make changes where necessary. So don’t hesitate – read on and start tracking!

10 Financial Metrics for Startups: How to Grow and Scale Your Business

By understanding and tracking financial metrics, startups can make sound financial decisions to help them grow and scale their businesses. Here are the top ten financial metrics that every startup should track:

1 . CAC payback

It is one of the key financial metrics for startups. It tells you how long it takes for a company to earn back the money it spends on acquiring new customers.

For example, if a company spends $100 on marketing and acquisition in a month, and they add 10 new customers that month, their CAC payback period would be 10 months. The shorter the payback period, the more efficient a company is at acquiring new customers.

CAC payback is a useful metric for assessing the viability of a startup’s business model and for comparing different acquisition strategies. If a company has a long payback period, it may be indicative of a problem with their acquisition strategy, and they may need to rethink their approach.

2 . CAC

As a startup, it’s important to keep a close eye on your financial metrics. That’s why the CAC, or customer acquisition costs, is such a valuable metric to track.

This number tells you how much it costs to acquire a new customer, and it can be helpful in assessing the efficacy of your marketing and sales efforts. To calculate your CAC, simply divide your total marketing and sales costs by the number of new customers acquired.

Once you have your CAC, you can start to experiment with different marketing channels and strategies to see what brings in new customers at the lowest cost. By keeping a close eye on your CAC, you can ensure that your startup is making the most efficient use of its resources.

3 . Gross Margin

As a startup, it’s important to keep track of your financial metrics. One key metric is gross margin. Gross margin is the difference between revenue and the cost of goods sold. The higher your gross margin, the more profit-making your business is.

There are a few things you can do to increase your gross margin. First, you can increase your prices. Second, you can reduce your costs. And third, you can improve your product mix by selling more high-margin products. By keeping an eye on your gross margin, you can ensure that your startup is on the right track financially.

4 . Customer Lifetime Value

Financial metrics are essential for startups. They help to assess whether a company is on track to achieve its long-term goals and make necessary adjustments as needed. One of the most important financial metrics is the customer lifetime value (CLV).

CLV measures the total amount of revenue that a customer is expected to generate over the course of their relationship with a company. This metric is important because it helps to assess the profitability of a customer and determines how much a company should invest in acquiring and retaining them.

While CLV can be difficult to calculate, it is essential for startups to have a clear understanding of this metric in order to make sound financial decisions.

5 . MRR Churn

Financial metrics are essential for startups. They help to measure progress, assess risk and make informed decisions about the future. One of the most important financial metrics is MRR churn.

MRR churn is a measure of the monthly recurring revenue that is lost due to cancellations or downgrades. A high MRR churn rate can be a sign that a startup is struggling to retain customers or that its products are not meeting customer needs.

It is important to track the MRR churn rate over time to identify trends and take action to improve retention and reduce attrition.

6 . Average Revenue Per Account

Financial metrics are essential for any startup seeking to raise capital and grow its business. One of the most important financial metrics is the Average Revenue Per Account (ARPA).

ARPA measures the average revenue generated from each customer account and is a key indicator of a company’s growth potential. Startups can use ARPA to track their progress over time and compare their performance to other companies in their industry.

Additionally, ARPA can be used to assess the effectiveness of sales and marketing campaigns. By tracking ARPA, startups can gain valuable insights into their business and make informed decisions about where to invest their resources.

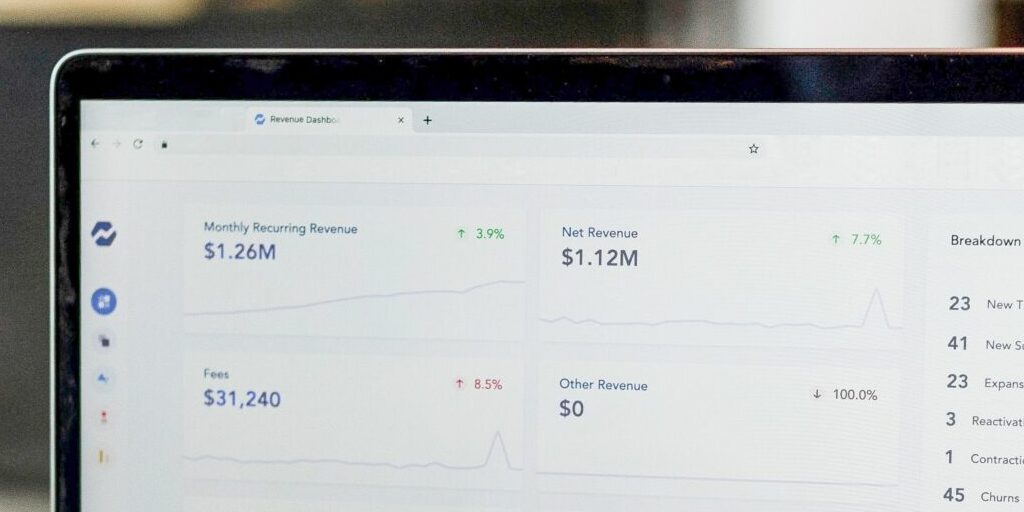

7 . MRR

As a startup, one of the most important things you can track is your MRR (monthly recurring revenue). This metric will give you a good idea of the health of your business and whether or not you’re on track to meet your financial goals.

There are a few different ways to calculate MRR, but the most common way is to take the total amount of recurring revenue from all customers in a given month and divide it by the number of customers. This gives you your average monthly recurring revenue per customer.

Another way to look at MRR is to take the total recurring revenue for a given month and divide it by the number of active customers. This gives you your monthly recurring revenue per active customer. Whichever way you choose to calculate it, tracking your MRR is an essential part of running a successful startup.

8 . Revenue

Financial metrics are essential for startups. They provide a clear picture of the company’s financial health and performance. However, choosing the right financial metrics can be tricky. There are dozens of different metrics to choose from, and each one measures something different.

The key is to choose metrics that are aligned with your business goals. For example, if you’re trying to maximize growth, you might want to track metrics like revenue or customer acquisition costs.

If you’re focused on profitability, you might want to track gross margin or operating expenses. By carefully choosing the right financial metrics, you can gain valuable insights into your business and make better decisions about where to invest your resources.

9 . Burn Rate

Financial metrics are essential for startups to track their burn rate. The burn rate is the rate at which a startup is spending its capital. It is important to keep track of the burn rate so that the startup can make adjustments to ensure that it does not run out of money before it has achieved its goals.

There are a number of different ways to calculate the burn rate, but the most common method is to divide the total amount of money spent by the number of months that have elapsed.

While the burn rate is an important metric, it is also important to keep in mind that it should not be the only financial metric that a startup tracks. Other important financial metrics for startups include revenue, profit, and cash flow.

10 . Runway

A runway is the amount of time a startup has to achieve its key milestones before it runs out of money. The metric is typically expressed in months, and it’s a key financial indicator for startups.

A longer runway gives a startup more time to reach important milestones, such as developing a product, acquiring customers, and generating revenue. A shorter runway may mean that a startup needs to raise more money sooner, which can be difficult to do if it hasn’t yet achieved significant traction.

The runway is an important metric to keep track of because it can give insights into a startup’s financial health and its ability to achieve key milestones.

Conclusion

So, there you have it – our top 10 financial metrics for startups. These are by no means the only ones that matter, but they provide a good starting point for understanding and measuring your company’s financial health. Keep in mind that as your business grows and changes, so too will the metrics you need to track. But using these basics should give you a strong foundation on which to build. How well are you doing on these measures? What steps will you take to improve? Let us know in the comments!

0