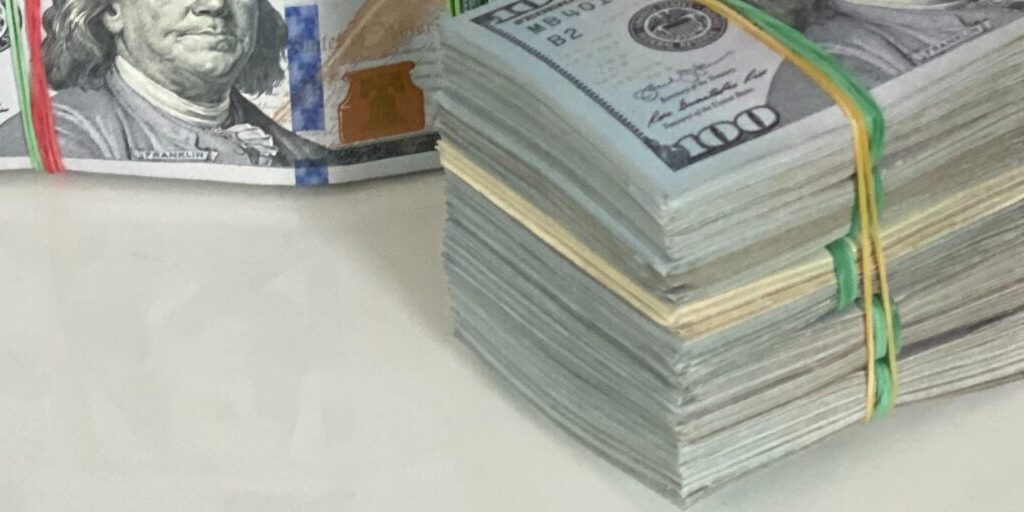

How To Turn 10k Into 20k?

There is no doubt that making more money is a top priority for many people. If you are one of those people, you may be wondering how to turn 10k into 20k. It’s not impossible – in fact, there are several ways to do it! In this blog post, we will discuss some of the best methods for increasing your income and turning 10k into 20k. So read on and get started today!

10 Tips For How to turn 10k into 20k

– Save

If you have 10,000 dollars, you probably don’t want to keep it all in cash. While it may be tempting to spend some of it, it’s important to think about how you can make your money work for you. One alternative to do this is to invest in stocks or mutual funds.

Over time, these investments can help you to grow your money and reach your financial goals. Another option is to put your money into a savings account or certificate of deposit.

These accounts typically offer higher interest rates than checking accounts, which can help you to earn more on your money over time. No matter what option you choose, remember that saving early and often is one of the best ways to reach your financial goals.

– Invest

Many people believe that in order to make money, they must first invest a large sum of money. However, this is not necessarily true. It is possible to turn a small investment into a larger one if the right choices are made.

For example, someone with 10,000 dollars could turn it into 20,000 dollars by investing in stocks, mutual funds, or other securities.

Of course, there is always the risk that the value of the investment will go down, but if the investor does their research and makes smart choices, they have a good chance of seeing their investment grow. In short, anyone can become an investor, regardless of how much money they have to start with.

– Make extra money

If you’re looking to turn a quick profit, there are a few things you can do to make extra money. One alternative is to invest in stocks or mutual funds. With a little research, you can find stocks that are undervalued and poised for growth.

Another alternative is to start your own business. With a bit of ingenuity and hard work, you can build a successful business from the ground up. Finally, you can also use your skills and talents to freelance or consult for other businesses.

Whether you’re an expert in web design or accounting, there are businesses out there that would love to hire you on a contract basis. If you’re willing to put in the effort, there are many ways to make extra money.

– Live below your means

It’s no secret that one of the keys to financial success is living below your means. But what does that actually mean? Essentially, it means spending less money than you earn and investing the difference. This may sound simple, but it can be difficult to do in practice.

There are a number of ways to live below your means, but one of the most effective is to create a budget and stick to it. By carefully tracking your income and expenses, you can get a better sense of where your money is going and make adjustments accordingly. This can help you free up more money to save and invest in the future.

Additionally, living below your means doesn’t mean that you have to deprive yourself of everything you enjoy. It simply means being mindful of your spending and making choices that align with your long-term financial goals.

– Create a budget

If you’re looking to turn 10k into 20k, creating a budget is an essential first step. When you know where your money is going, you can make more informed decisions about how to allocate your resources. There are a few key things to keep in mind when creating a budget.

First, be realistic about your income and expenses. It’s essential to have a clear picture of what you’re working with.

Second, remember to include both fixed and variable costs in your budget. Fixed costs are those that stay the same month-to-month, like rent or mortgage payments, while variable costs can fluctuate, like utility bills or grocery expenses.

Finally, don’t forget to factor in savings goals when creating your budget. By setting aside money each month for savings, you’ll be on your way to reaching your financial goals.

– Live frugally

It’s no secret that the economy hasn’t been doing well lately. This has caused a lot of people to re-evaluate their spending habits and look for ways to live more frugally. While it may seem like a daunting task, there are actually quite a few easy ways to cut costs without sacrificing your quality of life.

One simple way to save money is to cook at home more often instead of eating out. Not only will this save you money on your food bill, but it can also be healthier and provide you with an opportunity to bond with your family or roommates.

Another method to save money is to take advantage of discounts and coupons. Whether you’re shopping for groceries or clothes, there’s likely a coupon or sale that can help you save a significant amount of money.

Finally, one of the best ways to make your money stretch further is to develop a budget and stick to it. By carefully tracking your income and expenses, you can ensure that you’re not spending more than you can afford. By following these simple tips, you can easily turn 10k into 20k.

– Pay off debt

If you’re looking to pay off debt, there are a few simple strategies that can help you get out of the hole quickly. One of the most effective ways to pay off debt is to focus on the high-interest debt first. By making extra payments on your high-interest debt, you can save money on interest and reduce your overall balance more quickly.

Another helpful strategy is to take advantage of balance transfer offers. Many credit cards offer 0% APR for a period of time, which can give you a much-needed reprieve from interest charges. If you have access to extra cash, you can also consider making a lump sum payment on your debt.

By making a large payment, you can reduce your overall balance and save money on interest in the long run. Ultimately, there is no one-size-fits-all solution to paying off debt. But by employing some simple strategies, you can pay off your debt more quickly and get back on solid financial footing.

– Make a plan

If you’re looking to turn 10k into 20k, the best thing you can do is make a plan. Figure out how much you need to save each month to reach your goal, and then set up a budget to make sure you stick to it. Once you have a plan in place, it will be much easier to stay on track and reach your goal.

Start by looking at your income and expenses. Make sure you are bringing in more money than you are spending each month. If not, you’ll need to make some adjustments to your budget. Once you have a good idea of your monthly cash flow, you can begin setting aside money for your savings goal.

Create a dedicated savings account and set up automatic transfers from your checking account each month. This will help you keep your savings separate from your spending money and make it less tempting to dip into it for non-emergency purchases.

Finally, review your progress regularly and adjust your plan as needed. If you find that you are falling behind, don’t be discouraged – simply redouble your efforts and remain committed to reaching your goal. With a little effort and discipline, you can turn 10k into 20k in no time!

– Stay disciplined

When it comes to investing, discipline is key. By staying disciplined and following a sound investment strategy, you can increase your chances of success and reach your financial goals. For example, let’s say you have $10,000 to invest.

If you invest this money in a diversified portfolio of stocks and bonds and hold onto it for the long term, you could see your investment grow to $20,000 or more.

On the other hand, if you make impulsive decisions and sell whenever the market fluctuates, you could end up losing money. So remember, discipline is essential when it comes to investing. By staying disciplined, you can help ensure that your investment portfolio grows over time.

– Have patience

In today’s world, it’s easy to get caught up in the hustle and bustle and lose sight of what’s important. With technology making everything so readily available, we often expect things to happen instantaneously. However, one of the most important things to remember is to have patience.

Good things take time, and that’s especially true when it comes to money. It takes time to save up enough money for your dream house or car. And it takes even more time to turn 10k into 20k. But if you’re patient and disciplined with your spending, it’s definitely possible. The same goes for patiently waiting for a promotion at work or for your favorite band to go on tour.

So the next time you find yourself getting impatient, remember to take a step back and be patient.

Wrapping Up

Making 10k into 20k may seem like a daunting task, but it’s definitely possible with some careful planning and discipline. By following the tips above, you can increase your chances of success and reach your financial goals. So be patient and stay disciplined, and you’ll be on your way to turning 10k into 20k in no time!

0